After eight quarters of carefully not telling us how many people actually pay for M365 Copilot, Microsoft finally published the number in their January 2026 earnings call. 15 million seats. That's 3.3% of the 450 million Microsoft 365 commercial installed base, after two years on the market and what MS describes as "the fastest adoption of any new M365 suite" in history.

To be fair, 15M is higher than 8M. That was the leaked number from August 2025 that prompted me to write the Microsoft 365 Copilot's commercial failure article, which received both a lot of hate and support in different channels. We still don’t know if the 8M number was accurate or whether its counted with the same criteria as the first official disclosure. But yeah, 3.3% adoption rate is better than the 2% that I assumed from 4 months earlier. So, congrats on beating this analyst’s estimates on the premium AI conversion rate, MSFT!🥂

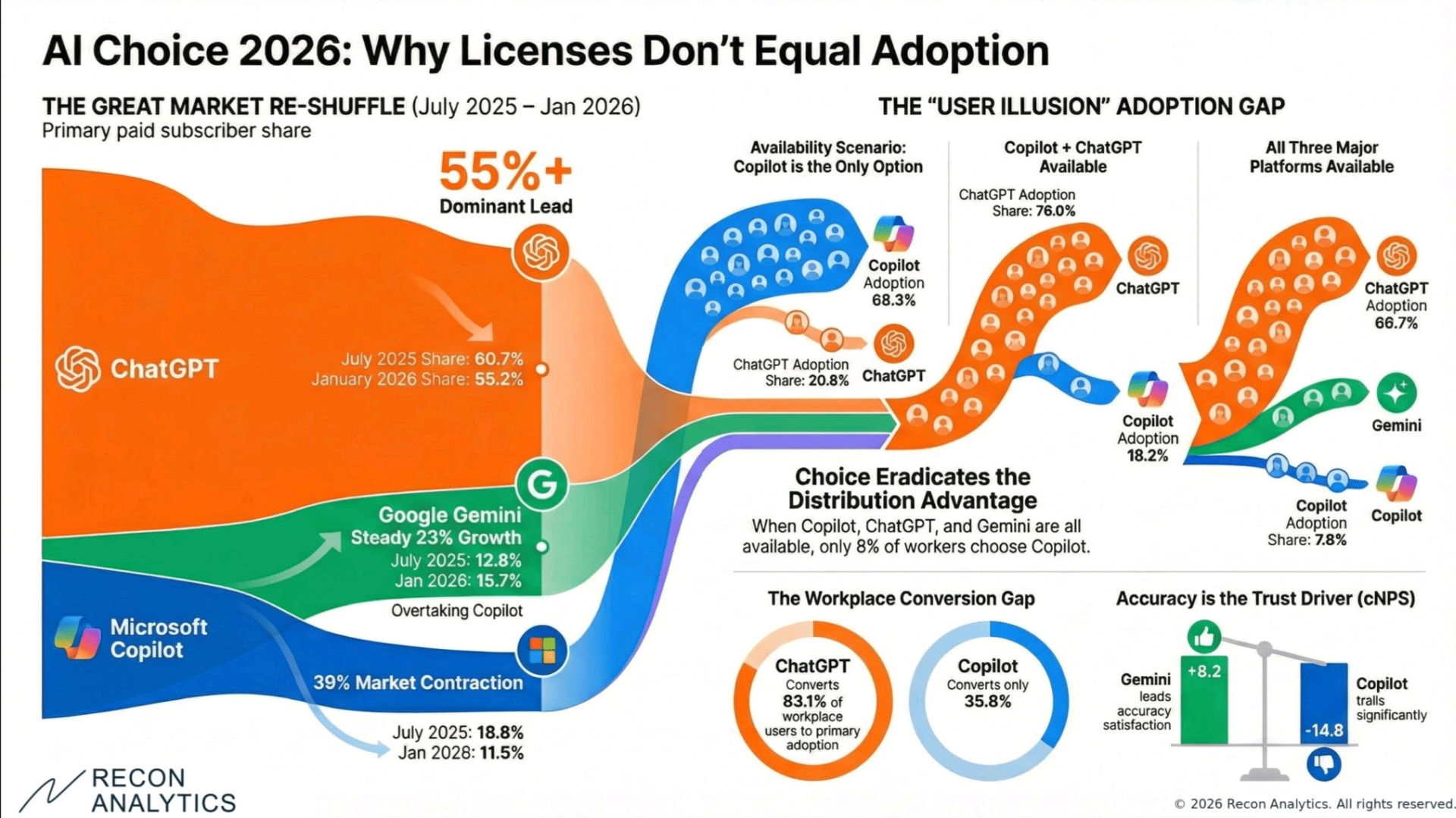

Converting users to premium AI subscriptions: OpenAI vs. Microsoft.

Is it a commercial success then? 15 million seats at $30/month list price would be $5.4 billion annualized. That's a proper business for sure. But analysts like Citi and J.P. Morgan have documented heavy discounting in the 40–60% range for competitive deals, especially the large deployments Microsoft loves to announce. A more realistic revenue figure could be something like $1.5–2.5 billion.

To update my own perspectives on things, I decided to do a status check on the numbers behind Microsoft’s AI business at the start of 2026. I went through the 4 most recent quarterly earnings transcripts (FY25 Q3 - FY26 Q2), covering April 2025 to January 2026, and asked my top-tier LLM assistants to pull every AI-related number they could find. Then I made them cross-reference this with independent data from Recon Analytics, SemiAnalysis, Similarweb, and other sources.

In today’s newsletter issue, I will cover the good, the bad and the ugly of what this data says to me when I interpret it.

The good parts of Microsoft’s AI business

GitHub Copilot looks like the clearest AI product success. The growth trajectory across 4 quarters was:

15 million users in April 2025

20 million users in July 2025

26 million users in October 2025

Then, Microsoft switched from reporting "users" to reporting "paid subscribers" in January 2026. The number: 4.7 million paying customers, up 75% year-over-year, with Pro+ subscriptions growing 77% quarter-over-quarter. If we’d assume a $19/month price point, we get to over $1 billion in ARR (annual recurring revenue).

Sure, the AI coding agent competition has definitely been heating up and I bet a shrinking share of developers actively choose GitHub Copilot today. Claude Code and other newer players are all the rage (even inside MS). But: it’s not a bad position for Microsoft to be the one that’s being chased by others. Coding in general has become the one area where LLM capabilities and shortcomings seem like an equation with a net positive outcome — at least when observed from a tool vendor perspective (some software devs might disagree).

Let’s think even bigger next. Azure as the underlying AI infrastructure grew at 35–39% in constant currency across all four quarters, hitting $75 billion annual revenue. Microsoft Foundry (née Azure AI Foundry) platform has 80,000+ customers, 80% of the Fortune 500, with over 250 customers on track to process more than a trillion tokens each this year.

In general, I don’t like the idea of using token count as a badge of honor. It’s like saying “we burned over X trillion liters of oil for achieving Y”, i.e. you measure a factor that should not be a positive thing. But in this case, when just thinking about the token factory of Azure as a business, they are the oil company. Demand for the products = good business. With Foundry positioned as a global LLM marketplace rather than merely an OpenAI-only shop, I see them as the enterprise go-to provider that can reap rewards from the AI spending craze of business customers.

What else? Dragon Copilot in healthcare went from 9.5 million patient encounters per quarter to 21 million in a year, with over 100,000 medical providers. Doctors may potentially save hours per day on documentation, freeing up time from highly paid professionals to other work. While I’ve seen some criticism towards the product from users posting online, I’d say the state of business for MS is pretty solid here.

The bad news around Copilot

Let’s return to M365 Copilot and what Microsoft have said about it in earnings calls:

FY25 Q3: "Hundreds of thousands of customers," growth "tripled year-over-year." No seat count.

FY25 Q4: "Largest quarter of seat adds since launch." No seat count.

FY26 Q1: "90% of Fortune 500 use it," PwC deployed 200,000 seats. Still no total.

FY26 Q2: fifteen million seats.

The selective language used with M365 Copilot is revealing. "Multiples more" enterprise Chat users than paid Copilot users — meaning the free tier dwarfs the paid product. "Daily active users increasing 10× year-over-year" — from what base? We don't know, because that's never been disclosed either. "Accelerating seat growth quarter-over-quarter" — sure, but 160% growth from a small number is still a small number.

Let’s look at independent data next. Recon Analytics surveyed over 150,000 enterprise users in January 2026. When people had access to all three platforms — Copilot, ChatGPT, and Gemini — only 8% chose Copilot as their preferred tool.

“Copilot’s decline from 18.8% in July 2025 to 11.5% in January 2026 represents a 39% contraction in market position among U.S. paid AI subscribers.”

Ouch. I wrote about the problem of how users don’t actively choose Copilot already in July in the Plus subscriber exclusive issue. I didn’t have as clear numbers to prove the hunch back then. Even if this new data is just about US customers, it’s pretty brutal for Microsoft’s competitiveness in the market.

According to this research, Copilot's paid subscriber share dropped from 18.8% to 11.5% between July 2025 and January 2026, while ChatGPT and Gemini gained. Perhaps the most telling finding: 70% of users initially preferred Copilot (it's right there in the Office apps they already use), but after trying alternatives, only 8% kept choosing it. This retention issue will be a far bigger concern than getting customers to subscribe for M365 Copilot for the first time.

SemiAnalysis posted their February 2026 analysis with a line that captures the real problem: "Claude for Excel effectively is what Copilot for Excel should have been, but it was launched by an external party on their own first-party product." An outside competitor shipped a better AI experience on Microsoft's own application than Microsoft's $30/seat/month product could deliver. When the Recon Analytics data says only one in twelve users choose Copilot given alternatives, this is why. The quality obviously does not meet customer expectations.

Now, let’s (not) talk about AI revenue

This has been mentioned in my earlier newsletters but it’s worth restating: Microsoft stopped reporting on their AI revenue one year ago. The AI revenue run-rate was last disclosed at approximately $13 billion in FY25 Q2 (January 2025). Then, the metric disappeared from their investor comms. AI's point contribution to Azure growth was disclosed once — 16 points in FY25 Q3 — and never mentioned again.

M365 Copilot revenue has never been reported separately, instead it's buried in "ARPU growth driven by E5 and M365 Copilot." The Copilot family monthly active users were last updated at 150 million in FY26 Q1 and conspicuously not refreshed in FY26 Q2. GitHub Copilot ARR has never been disclosed in an earnings call.

Companies stop reporting metrics that stop improving. Even if I picked Azure and GitHub Copilot to be in the good parts section of Microsoft’s AI business just a few paragraphs ago, we should not forget how the exact chunks of money gained from them remain undisclosed. In their absence, we hear anecdotes about specific customers (“PwC! Lloyds! Vodafone!”) and percentage growth rates that sound impressive — until you realize you’ve never been told what the base figure is.

Two beasts, one budget

SemiAnalysis drills deeper into the nature of the AI beast within Microsoft’s AI business:

“There are two beasts within Microsoft: Azure growth for public market investors and investing in Copilot to preserve the Office 365 product suite. To decisively win at one, it’s likely you must lose at the other. And right now Microsoft is one of the largest AI clouds in the world to companies like OpenAI and Anthropic. But they are renting GPUs to the barbarians who will ruin their castle in productivity software.”

Amy Hood, Microsoft's CFO, talked about this in the FY26 Q2 call. When asked about Azure growth, she explained that capacity allocation follows a priority order: first, M365 Copilot and GitHub Copilot and other first-party apps. Then R&D and product teams. Then, whatever's left, Azure third-party customers. She added: "If I had taken the GPUs that just came online in Q1 and Q2 and allocated them all to Azure, the KPI would have been over 40."

Azure has demand for the server capacity, which is a positive problem when your business is about renting servers. Yet Microsoft is not just a cloud infrastructure provider. Their market cap is based on a whole bunch of other offerings. This is the revenue split from the latest FY26 Q2 report:

Intelligent Cloud (includes Azure): $32.9B → 40.5% of total $81.3B revenue

Productivity and Business Processes (Office, Dynamics, LinkedIn): $34.1B → 42%

More Personal Computing (Windows, Xbox, Search): $14.3B → 17.5%

Asking the leading image gen model (Google’s Nano Banana Pro) to visualize MS revenue split.🙈

Azure itself isn't broken out separately within Intelligent Cloud (that segment also includes SQL Server, Windows Server, Enterprise Services, etc.), but Azure is widely estimated at roughly $20–22B per quarter based on the $75B+ annual run rate. That’s roughly 25–27% of total Microsoft revenue. Productivity & Business Processes (where M365 Copilot revenue sits) is bigger, yet it’s not growing as fast as Azure (16% vs. 29%). All the evidence I keep writing about in this newsletter suggests it is in fact facing challenges to meet internal expectations.

The urgency of the situation can be seen at the very top. Business Insider reported that Satya Nadella has stepped into a hands-on product management role for Microsoft AI, pulling away from day-to-day CEO duties. He’s also been actively showing personal vibe coded AI solutions that are now publicly visible on GitHub. When the CEO personally takes over a product line and gets his hands dirty with Visual Studio projects, the stakes have moved past strategic and into existential.

Subscribe to Plus to read the rest.

Become a paying subscriber of Perspectives Plus to get access to this post and other subscriber-only content.

Upgrade